China's purchase of a large consignment of U.S. corn has led to another jump in prices

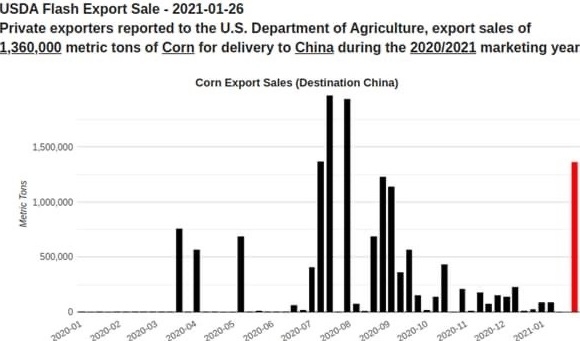

In yesterday's daily sales report, USDA reported yesterday about China's purchase of 1.36 million tonnes of U.S. corn, which stimulated speculative demand for futures of corn and soybeans due to possible increased demand in the data of culture from China.

the March corn futures in Chicago yesterday. offset Friday's losses and rose 4% to multi-year high of 211 $/t, which was updated two weeks ago.

According to traders, unexpected for the market concluded the company Cofco. Probably the move is not about one-time purchase, and several operations, which lasted for one to two weeks, but was included in the sales report too late.

Following the corn market soybean futures also rose to 508,5 $/t, recouping Friday's losses on expectations of a resumption of purchases by China and on the data about active export of soybeans from USA, which this season amounted to 45.2 million tonnes, which almost corresponds to the total volume of exports of the previous season.

the Market was supported by data on delay harvesting of soybeans in the Brazilian state of Mato where because of the rains threshed soybeans only 1% of the area compared with last year's 10%. This will keep the corn second crop and may reduce its yield.

In Ukraine after the collapse earlier in the week 15-20 $/ton, corn prices rose yesterday for 2-5 $/t, however, restricts further growth of the low demand from buyers who are not ready to pay a high price. Price offers of Ukrainian corn are 260-265 $/t FOB, but the prices demand for shipments to Asia remain at the level of 285-295 $/t C&F due to the increase of proposals of Australian feed wheat and Argentine corn, which is offered at 240-245 $/t FOB. We can only hope that demand from China, which actively buys American corn is now cheaper than Ukrainian.