Trump said he was not considering suspending tariffs on any countries, and global stock indexes responded with a new fall.

Stock market participants are closely watching all the news, trying to find at least some logic in Trump's actions. However, he has stated that he does not plan to reduce or eliminate tariffs for any country, as this would contradict the protection of American economic interests. The White House has confirmed that Trump intends to veto a bill that limits his authority in the field of customs policy. And China has said that it will not submit to Trump's new tariff ultimatums and will intensify the fight.

Asian stock markets started Monday with a sharp decline amid Trump's announcement of imposing an additional 50% tariff on China if it does not cancel the 34% tariff imposed in response to Washington's tariff policy.

The MSCI Asia Pacific Index, which tracks large- and mid-cap companies in 13 Asia-Pacific countries, plunged more than 7% yesterday, its worst performance since 2008. Chinese stocks were the worst hit. The benchmark index of Chinese stocks traded on the Hong Kong stock exchange fell more than 10%.

Later, US stock markets rose sharply amid rumors that Trump might delay the imposition of tariffs for 90 days, but when the White House denied this, prices fell back to Friday's closing levels.

During the session, the Dow Jones index fell and rose by 6.5% or 2,595 points, which was the largest daily fluctuation in history, but at the end of trading it decreased by 0.91% to 37,965.6 points. The S&P 500 index fell and rose by 4.7% during trading, but closed down by 0.23%. The high-tech Nasdaq fell and rose by 5%, and closed up by 0.1%.

The pan-European STOXX 600 index has fallen for four straight sessions and fell another 5.8% yesterday, closing in on its biggest one-day drop since the start of the COVID-19 pandemic. Germany's trade-sensitive index was the worst hit in the eurozone, falling 6.1%.

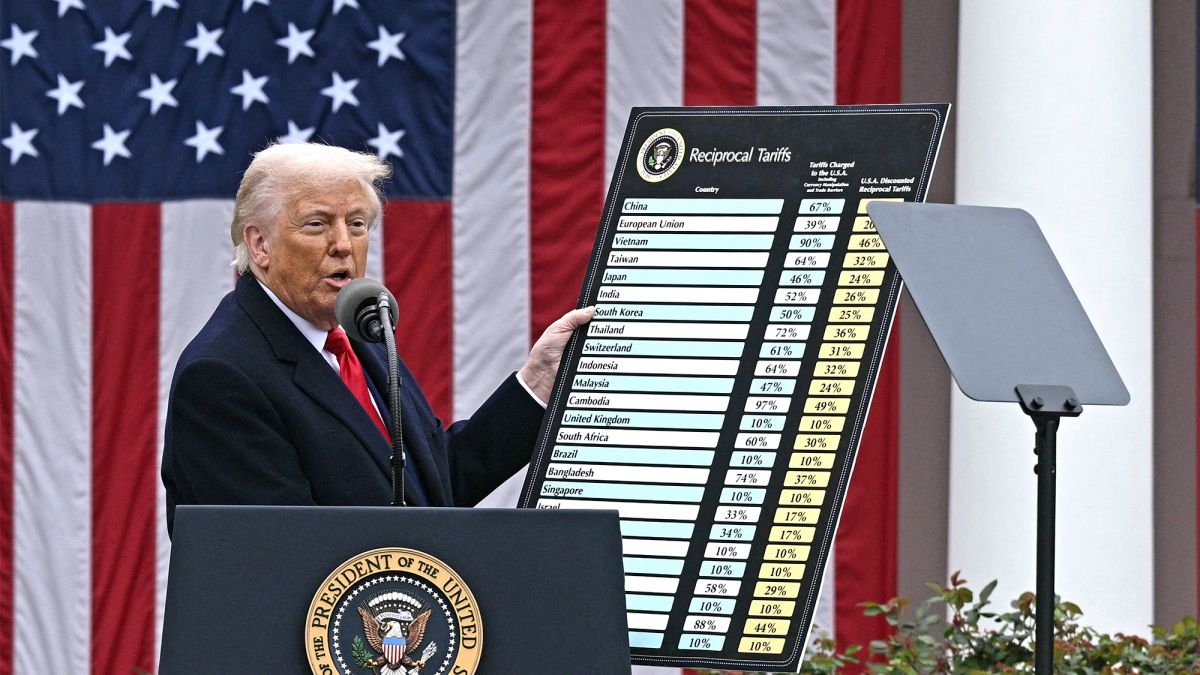

EU countries plan to impose import duties on up to $28 billion worth of US goods in the coming days in response to Trump's 25% tariffs on European steel, aluminium and cars and 20% on all other goods from April 9. The European Commission is proposing to impose tariffs on American meat, cereals, wine, timber, clothing, bourbon and household goods (appliances, toilet paper, chewing gum and others). The vote on this list will be held on April 9.

China has already prepared its response to the US tariff war. The People's Bank of China said it would fully connect a cross-border digital yuan settlement system to ten ASEAN countries and six Middle Eastern countries, so 38% of global trade will bypass the US dollar-dominated SWIFT system and work directly with blockchain technology.

China’s digital currency bridge has reduced the speed of clearing payments to 7 seconds, while SWIFT makes cross-border payments with a delay of 3-5 days. In the first test between Hong Kong and Abu Dhabi, the company paid a Middle Eastern supplier in digital yuan. The funds no longer went through six intermediary banks, but instead arrived in real time via a distributed ledger, and the processing fee was reduced by 98%. Against the backdrop of the new “instant payment”, the traditional clearing system, dominated by the US dollar, already looks clumsy. The blockchain technology used by the digital yuan not only makes transactions traceable, but also automatically ensures compliance with anti-money laundering regulations.

Today, 87% of the world's countries have completed the adoption of the digital yuan system, and the scale of cross-border payments has exceeded 1.2 trillion US dollars. While the United States is debating whether digital currency threatens the status of the US dollar, China has quietly built a digital payment network that covers 200 countries. This quiet financial revolution is not only about monetary sovereignty, but also about who can control the life path of the future global economy.