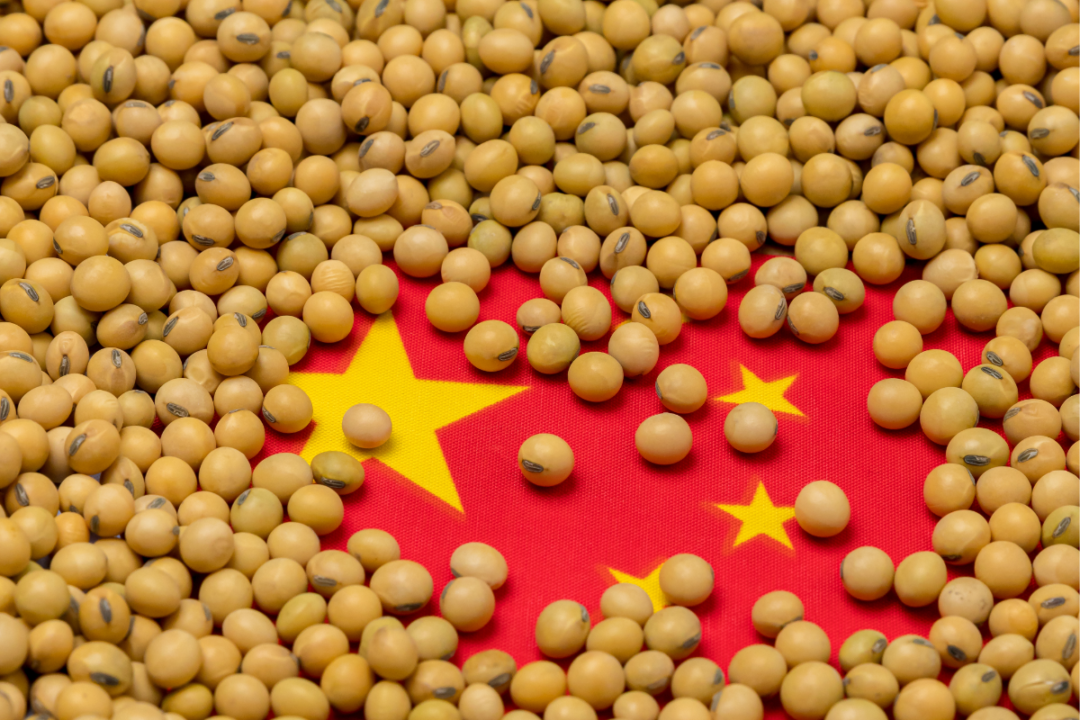

China's soybean glut fueled by buoyant imports from Brazil lowers domestic meal and oil prices

China, the world's largest importer of soybeans, continues to increase its purchases, which has already led to a surplus in the domestic market and a drop in soybean meal and oil prices. Therefore, the import of soybeans may decrease significantly in the coming months, which will negatively affect exports from the USA.

According to the General Administration of Customs (GACC), in June, compared to May, the PRC increased soybean imports from Brazil by 2.2% to 9.72 million tons, which is higher than the 9.51 million tons imported in June 2023. For 6 months In 2024, China imported 34.4 million tons of soybeans from Brazil, which is 16.1% higher than the corresponding indicator of 2023 and is a record value for this period. Brazil overtook the USA in the supply of soybeans to the People's Republic of China, providing 70% of oilseed imports.

The surplus of soybeans may reduce import volumes in September-December, the period of the most active soybean exports to the United States.

China's soybean glut is growing due to record imports and low demand for animal feed. On the Dalian exchange, soybean meal prices fell by 8% in 3 weeks, while soybean oil prices fell by 4% in the week and analysts expect further declines.

From soybeans, China obtains high-protein soybean meal, which is used to feed the world's largest herd of pigs, while soybean oil is used for cooking. However, the slowdown in the economic development of the country, which consumes half of the world's pork production, reduces the demand for meat and feed.

Significant supplies of soybeans against the background of low demand for products and processing reduce the margin of its processing. At the beginning of June, it was already negative, and during the month it fell to minus 600 yuan/t, which is the biggest decline since February.

According to Reuters, state soybean supplier Sinograin has auctioned about 9.68 million tonnes of soybeans since February, but processors bought only 21%, or 2.08 million tonnes. Last year, 27% of soybeans were auctioned and participation was also higher.

Traders believe soybean imports, primarily from Brazil, will reach a record high in July amid low prices and the prospect of Trump winning the US presidential election, which will reignite trade disputes.

At the same time, the MSG of China predicts a decrease in soybean consumption in 2024/25 compared to the previous season from 115.24 to 114.56 million tons.