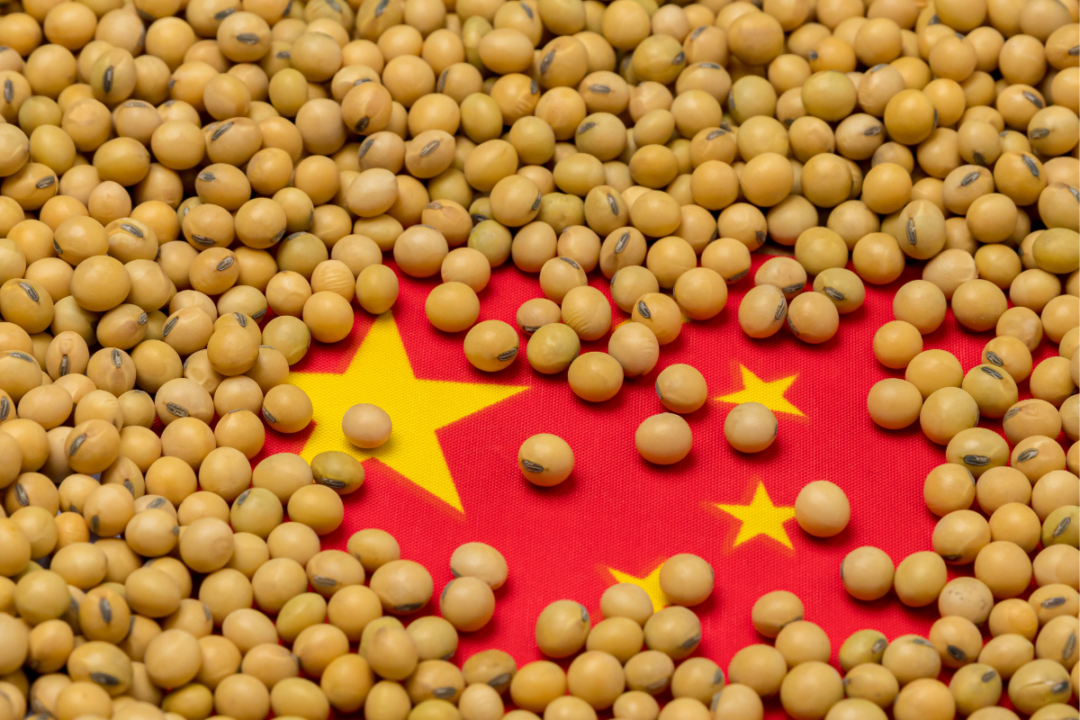

China agreed to buy 12 million tons of American soybeans by the end of January, which supported soybean quotes in the US

U.S. Treasury Secretary Scott Bessant said on Thursday that China has agreed to buy 12 million tons of U.S. soybeans by the end of January and 25 million tons each year for the next three years. The deal will be signed as early as next week, Bessant said, Reuters reported. This has added a new boost to U.S. soybean prices.

We will remind you that after yesterday's meeting, Chinese President Xi Jinping and US President Trump did not make statements to the press or hold a joint press conference with information about the agreements, so the markets reacted to the situation by lowering quotes at the opening of trading.

During the trade dispute with the US, China used soybean imports as a leverage factor, which strengthened its position in the latest round of negotiations.

In yesterday's news, November soybean quotes on the Chicago Board of Trade rose by 1% to $401/t (+4.4% for the week and +7.5% for the month), and January futures rose to the highest level since mid-2024 at $407/t.

On the eve of the leaders' meeting, China's COFCO bought three batches of American soybeans, demonstrating its willingness to soften negotiating positions.

Base soybean prices at FOB terminals on the US Gulf Coast and Pacific Northwest, where soybeans are shipped for export, rose sharply after US officials announced China's agreement to resume purchases of US soybeans and made purchase commitments for the next three years.

Exporters raised prices for FOB Gulf Coast and Pacific Northwest shipments this week in anticipation of stronger demand from China, but traders were unable to confirm new purchases on Thursday.

Prices for CIF Gulf soybean barge deliveries in October and November rose to $435-440/t FOB (a premium of $35-36/t to the November futures price on CBOT).

The sharp increase in prices for American soybeans will provide more competitive opportunities for selling Ukrainian soybeans to the EU and Egypt.