In addition to corn, China also plans to import soybean meal from Brazil

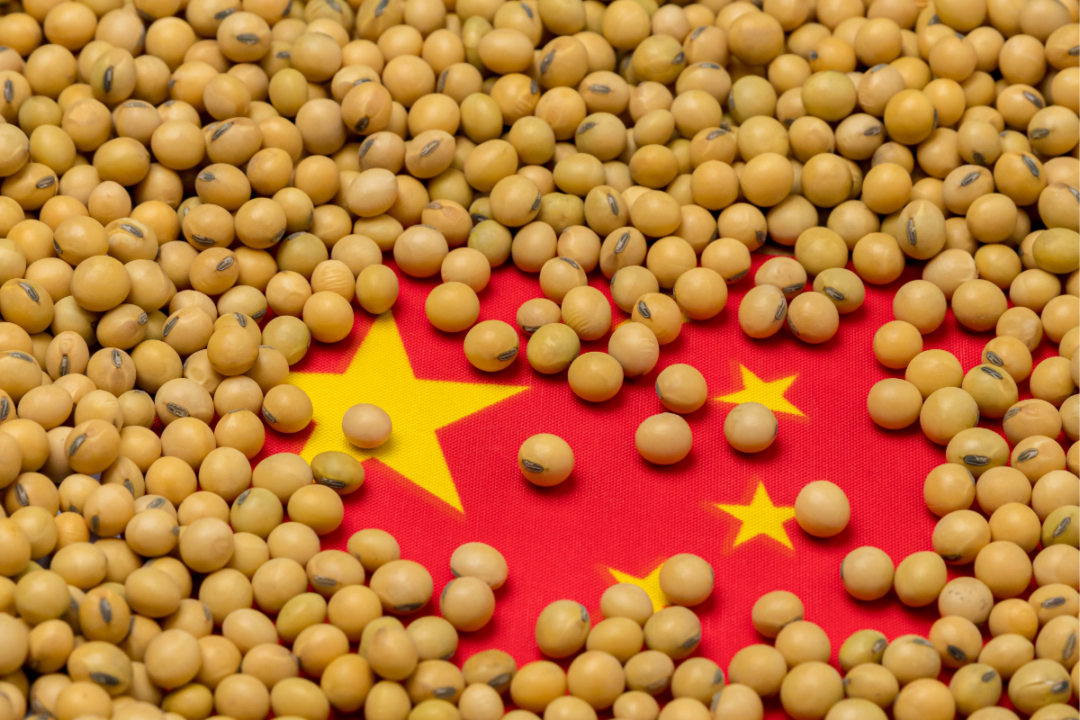

China, the world's largest producer and consumer of soybean meal, plans to begin large-scale imports from Brazil in the face of domestic shortages, but market participants doubt processors will import even if they are allowed to do so.

The decrease in the volume of soybean imports to the PRC began as early as July 2022, which led to a reduction in the supply of soybean meal in the domestic market and an increase in prices.

According to Chinese customs, soybean imports in the 3rd quarter decreased by 9.1% compared to the corresponding period last year, in particular in October - by 19% to 4.14 million tons, which is the lowest October figure since 2014. As a result, spot prices for soybean meal increased by 5.6% for the month and are already 61% higher than last year's level.

Analysts expect China to increase soybean imports to 7.5 million tons in November, and to 9.5 million tons in December amid active purchases in the United States, but 1.5 million tons of soybeans must be returned to state reserves every month, which individual processors reduced in an attempt to reduce the deficit.

According to S&P Global Platts, demand for near-term deliveries remains open. Thus, on November 14, with the demand for December deliveries of 6 million tons, only 76% or 4.6 million tons were closed, while the closing of January deliveries is only 25%.

Chinese buyers expect soybean prices to drop in January, when Brazil begins harvesting its record crop. After the recent permission to import Brazilian corn to China, the Chinese authorities are considering the possibility of large-scale imports of soybean meal from Brazil. The paperwork process is ongoing and could be completed in the near future, and the market is discussing how this will affect China's feed mills and the global soybean market in general.

Chinese producers report available offers for December shipments of Brazilian meal, which will arrive in the country as early as February. However, market participants doubt that processors will engage in imports if the relevant permit is obtained, as they do not have the necessary experience and are used to buying meal in the local market in yuan rather than foreign currency. In addition, there are risks of quality loss, as the transport from Brazil to China takes a month, and sea conditions can increase the moisture content.

China's livestock farmers will replenish their pig and poultry stocks in March and April, so feed demand will increase at the end of the second quarter. If the import of soybeans is not increased in the first quarter, then in the second quarter it will be necessary to increase the supply of soybean meal from Brazil.

Southeast Asia is the main market for South American soybean meal. Its largest importer is Indonesia, which buys more than 2 million tons of meal from Brazil for its poultry farmers. Vietnam also buys soybean meal from Brazil, although 60% of annual imports of 5.2 million tons of meal come from Argentina.