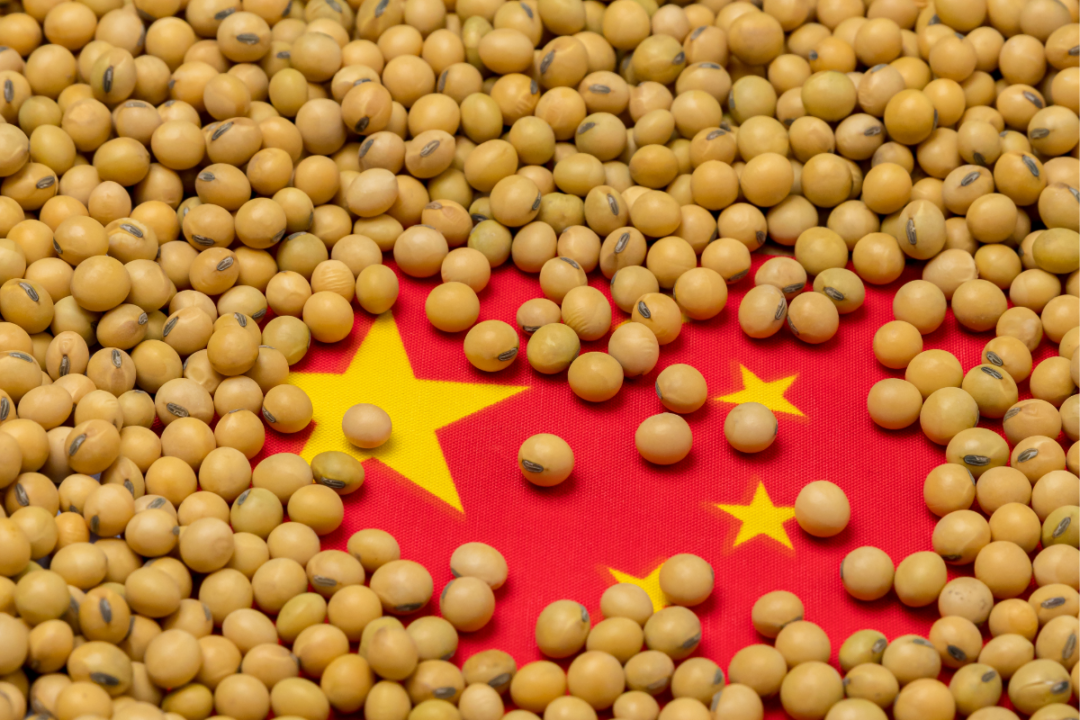

An increase in the supply of Brazilian soybeans is driving down prices, particularly in China

Soybean prices in China fell sharply this week and WTO futures fell to a 5-year low amid increased soybean sales from Brazil and reduced demand for near-term supplies.

According to Platts, part of S&P Global Commodity Insights, China soybean prices fell 23% (-37% for the week) during March 17 alone and traded at a premium of just $28/t to May SWOT futures , which yesterday rose by 0.9% to $546/t (-4% for the month). At the same time, Brazilian soybeans fell in price by 3.4% for the week and traded at $577.61/ton on March 17.

According to Patria Agronegocios estimates, soybeans in Brazil are harvested on 63.1% of the area (71.7% last year), but export sales are only 38% due to the delay in harvesting and the collapse of prices.

In the first three weeks of March, Brazil increased soybean exports by 3.3 million tons to 7.3 million tons compared to the same period in February. This indicates that export rates will increase in March - May. However, the demand for soybeans from China still remains low due to significant reserves of meal in the country.

According to CNGOIC, as of March 16, China's weekly soybean processing volume decreased by 1% from the previous week to 1.45 million tons, which is 30% lower than the corresponding figure in February, but 1% higher than last year.

Soy stocks in China as of March 16 amounted to 3.5 million tons (-5% for the week), soybean meal – 570 thousand tons (-11% for the week, +84% for the year), soybean oil – 630 thousand tons (- 14% per year).

The lack of progress in China's hog recovery is reducing soybean demand, processing margins and soybean meal prices, forcing processors to slow operations.

As of March 17, the cheapest soybean meal was trading at 3,940 yuan/t or $591/t, down 11.5% from the previous month and an 8-month low. Accordingly, the profitability of processing was minus 230 yuan/t ($-34.5/t).

A sharp drop in soybean prices interested some buyers, but processors stopped purchases, realizing that soybeans on the CFR - China will continue to fall in price.

Chinese importers are likely to continue to hold back on purchases to keep global soybean prices down amid a significant supply glut from Brazil that has built up due to delayed harvests. Therefore, in April - May, we can expect a sharp decrease in soybean prices, even despite the decrease in the harvest in Argentina.