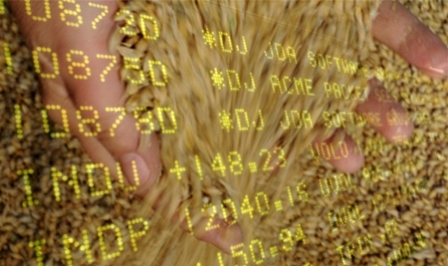

The USDA report accelerated the fall in wheat prices

at Last week's auction of wheat exchanges were held in the absence of factors supporting, and in anticipation of Friday's USDA report quarterly balances and crop acreage in the new season.

wheat Stocks in the United States on March 1 made up the second largest over the past 31 years the level 43,27 million tonnes, which is 6.3% higher compared to the 2018 and 2.2% exceeding expert expectations.

the Forecast of the acreage under wheat was reduced to 45,75 million acres, compared with 47.8 million acres last year, and of 46.92 million acres, which was predicted by traders. Reduced sowing area of durum wheat and spring due to snow and excessive moisture of soils in the Midwest that supported the quotation of wheat of the new harvest of wheat, which is now more expensive than the may contract.

Under pressure from a new report, the market for U.S. wheat has accelerated the decline.

May futures in the US declined:

3,22 $/t to 157,99 $/t for solid winter HRW wheat in Kansas city

1,93 $/t to 203,83 $/t on a firm spring HRS wheat in Minneapolis.

- 2,48 $/t to 168,19 $/t for SRW soft winter-wheat in Chicago

Wheat area has dropped after Chicago, and even the fall of the Euro to 1,123 $/ not supported prices.

- the May futures for milling wheat on MATIF fell by 0.25 €/t to two-week low 185,75 €/t or 208,56 $/t

Argentine wheat remains the most competitive in the world market and are interested in buyers from Asia and Brazil, while prices for black sea grain remain high due to the limited number of proposals from manufacturers.