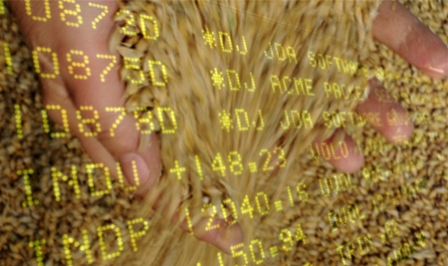

After the collapse of stock, commodity markets yesterday increased significantly

on Tuesday, the stock markets began to recover after the rapid collapse on Monday at 3-5%. Commodity exchanges have confirmed that they are moving in accordance with the balance of production and consumption, as well as under the influence of weather news.

Despite the increase in forecasts of soybean production in Brazil, traders are concerned about the fate of the crop in Argentina. Although there were intermittent rain, meteorologists predict rainfall below normal.

Soybean meal rose by 1.4% to 370 $/t and oil rose 1.8% to 731,7 $/t

- Soybean futures rose 1.4 percent to 365 $/t and above its 50-day and 200-day average levels.

the March futures on corn grew by 1.1% to 143,5 $/t on the back of lower forecasts for corn harvest in Brazil by 1.7 million tonnes to 93.3 million tons, in Argentina by 1.5 million tons to 40.5 million tons, traders expect the publication of Thursday's monthly USDA report, which can be reduced the production forecasts for South America and reduced carryover stocks of soybeans and corn.

After a four-day drop, the market for American wheat on Tuesday began to grow to support the markets of corn and soybeans. The speculative investors have been buying.

Prices were supported by weather news. The promised heavy snowfall has turned into a slight snow, so the threat of drought remains.

March U.S. wheat futures grew:

by 2.66 $/t to 172,32 $/t for solid winter HRW wheat in Kansas city

to 2.39 $/t to 223,49 $/t on a firm spring HRS wheat in Minneapolis.

- 2.21 $/ton to 163,97 $/t for SRW soft winter-wheat in Chicago